728x90

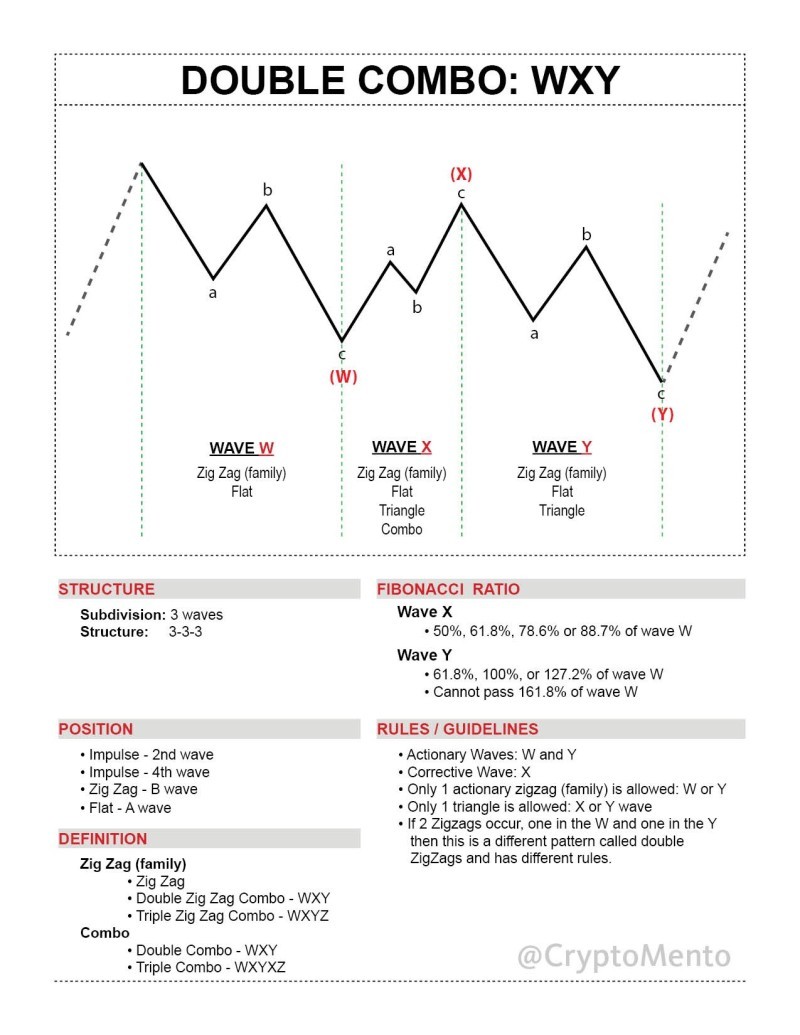

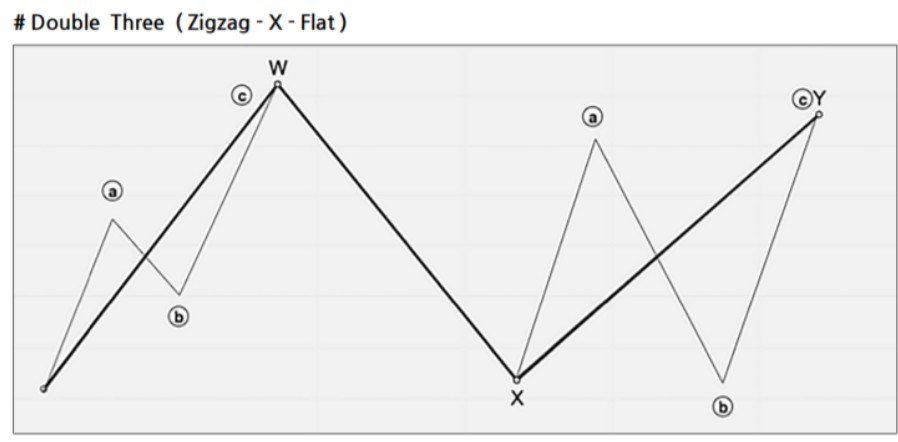

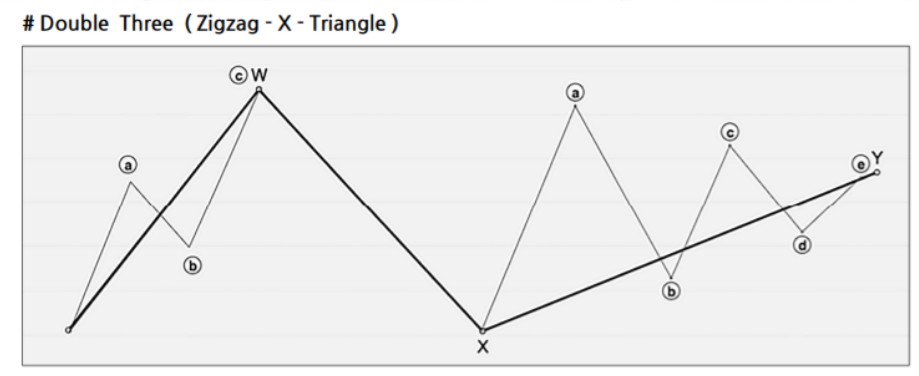

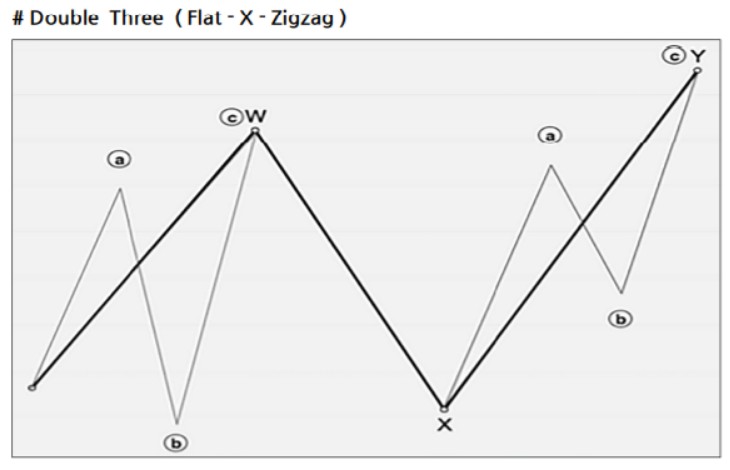

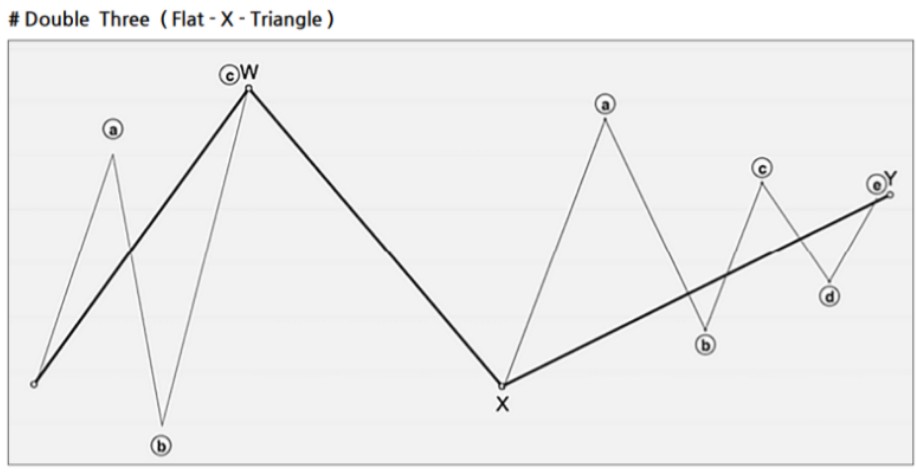

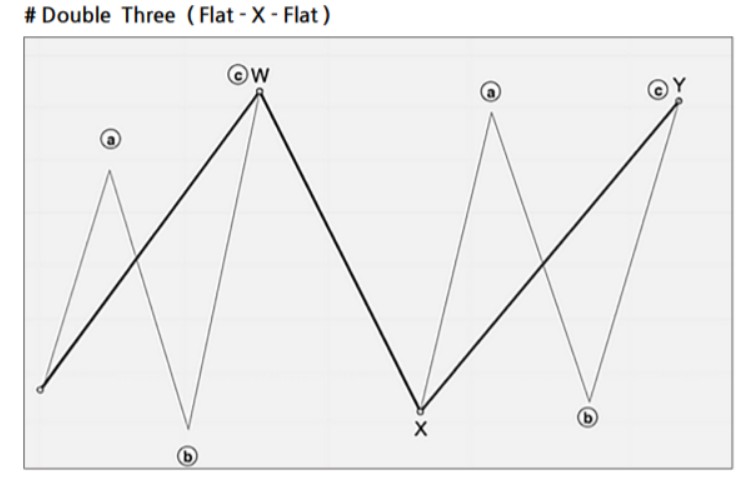

Double Combo Pattern

- Structure: W-X-Y (3 waves)

- Appearance Locations:

- In an impulse wave, during the 2nd or 4th wave

- In a zigzag correction, as the B wave

- As the A wave in a flat correction

- Wave Composition:

- W Wave: Zigzag, double zigzag, triple zigzag, or flat

- X Wave: Any form of corrective wave

- Y Wave: Zigzag, double/triple zigzag, flat, or triangle

- Fibonacci Ratios:

- X wave: 50–88.7% of the W wave

- Y wave: 61.8–127.2% of the W wave (should not exceed 161.8%)

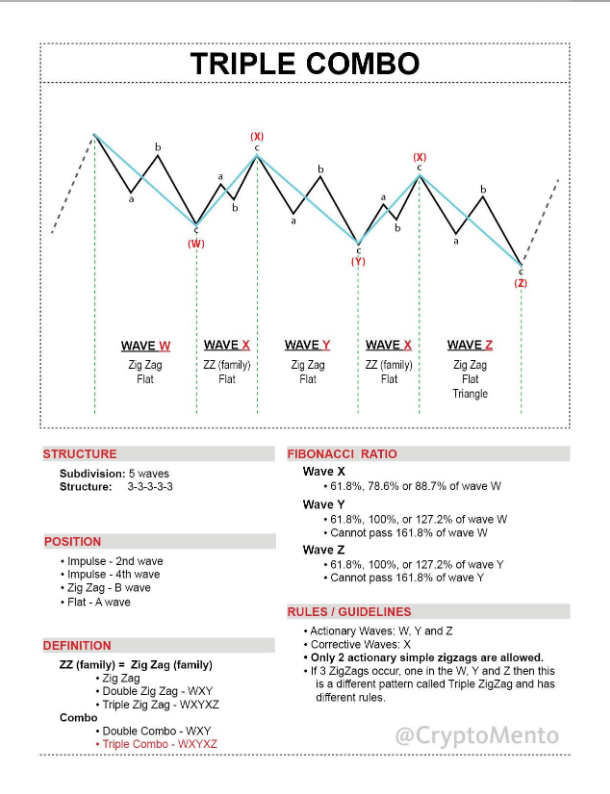

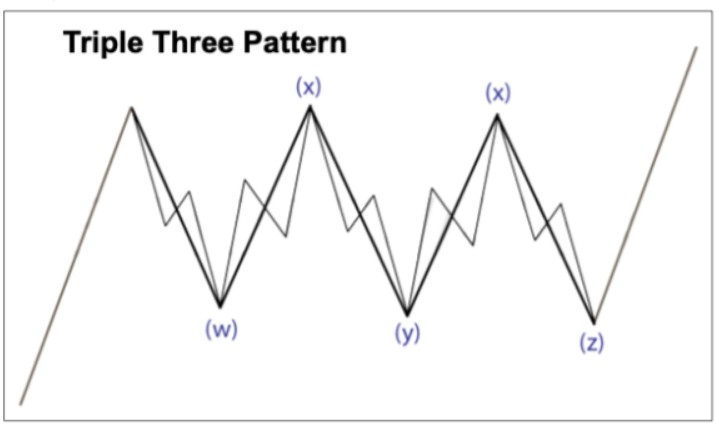

Triple Combo Pattern

- Structure: W-X-Y-X-Z (5 waves)

- Appearance Locations:

- Similarly, it can appear in the 2nd or 4th wave.

- Wave Composition:

- W Wave: Zigzag or flat

- X Wave: Zigzag, double zigzag, triple zigzag, or flat

- Y Wave: Zigzag or flat

- Next X Wave: Zigzag, double zigzag, triple zigzag, or flat

- Z Wave: Zigzag, flat, or triangle

- Fibonacci Ratios:

- X wave: 50–88.7% of the W wave

- Y wave: 61.8–127.2% of the W wave (should not exceed 161.8%)

- Z wave: 61.8–127.2% of the Y wave (should not exceed 161.8%)

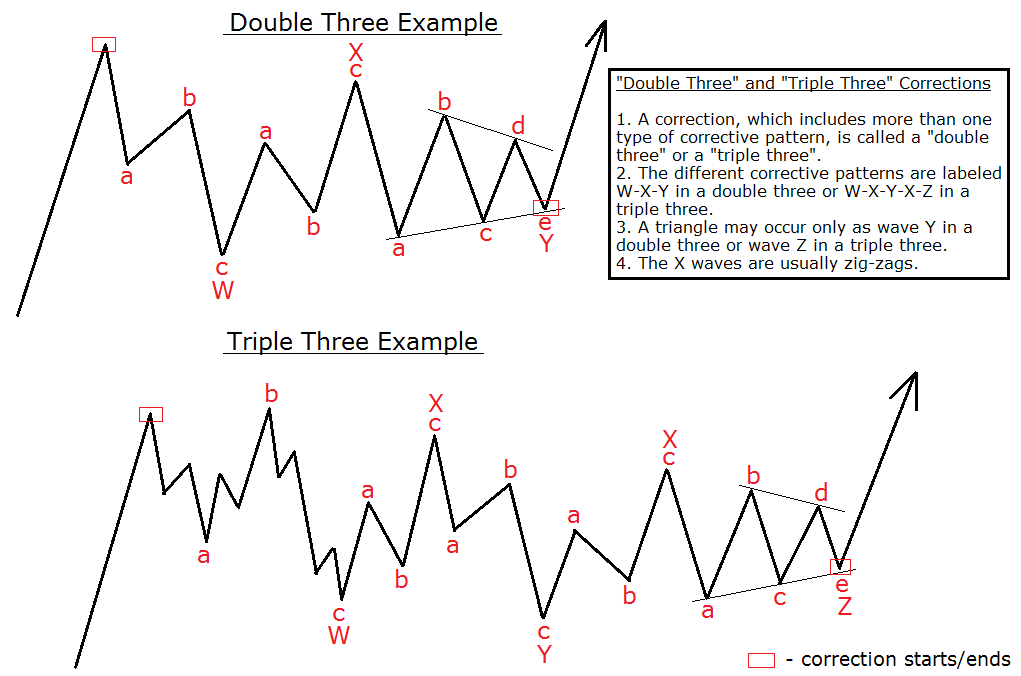

Examples of Complex Corrections

Complex corrective patterns occur when market corrections become intricate, combining various forms of corrective waves. For example, a stock might show the following pattern after a strong rally:

- Double Combo: After a strong rise, if the stock experiences a zigzag correction in the W wave, followed by a complex correction in the X wave, it might form another zigzag pattern in the Y wave.

- Triple Combo: As the market undergoes corrections, multiple zigzag and flat corrections might combine to form a pattern. For instance, the first W wave could be a zigzag, followed by a flat correction in the X wave, then the second Y wave appears as another zigzag, leading to subsequent X and Z waves.

These complex corrective patterns play a crucial role in identifying price direction. Applying various forms and Fibonacci ratios is essential for determining accurate entry and exit points.

728x90

댓글