The Elliott Wave Theory is a popular technical analysis tool used to predict the future behavior of financial markets by identifying recurring wave patterns. Here’s an overview of its main concept, focusing on the basic impulse wave.

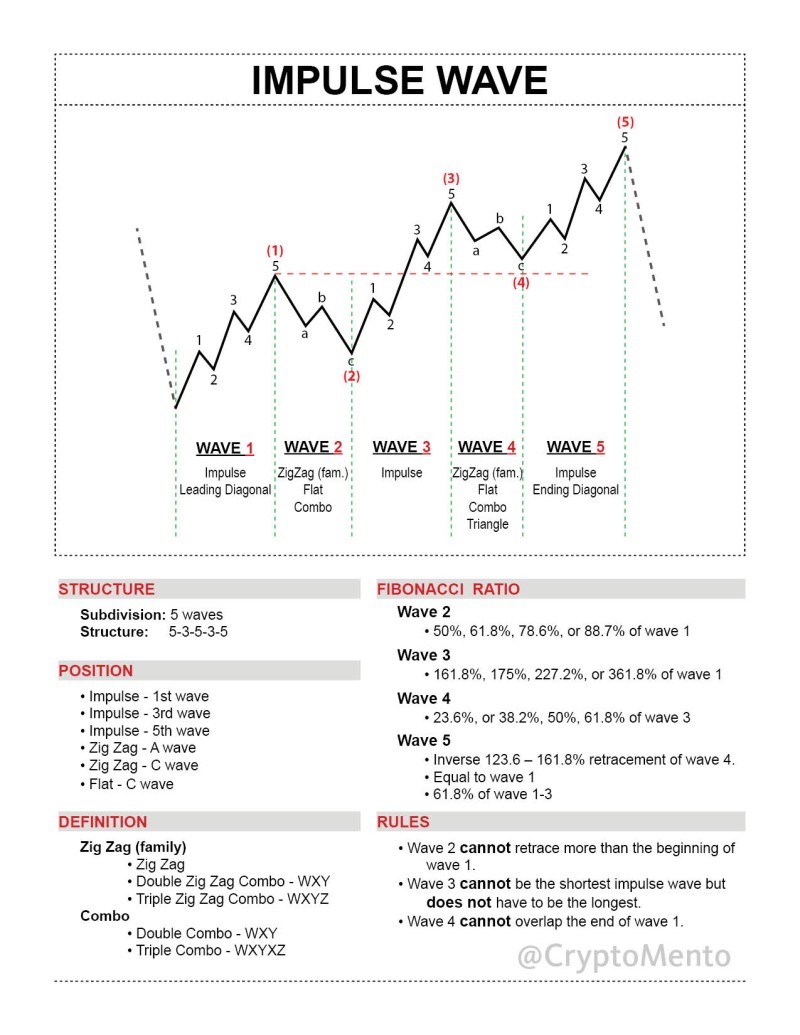

Impulse Wave

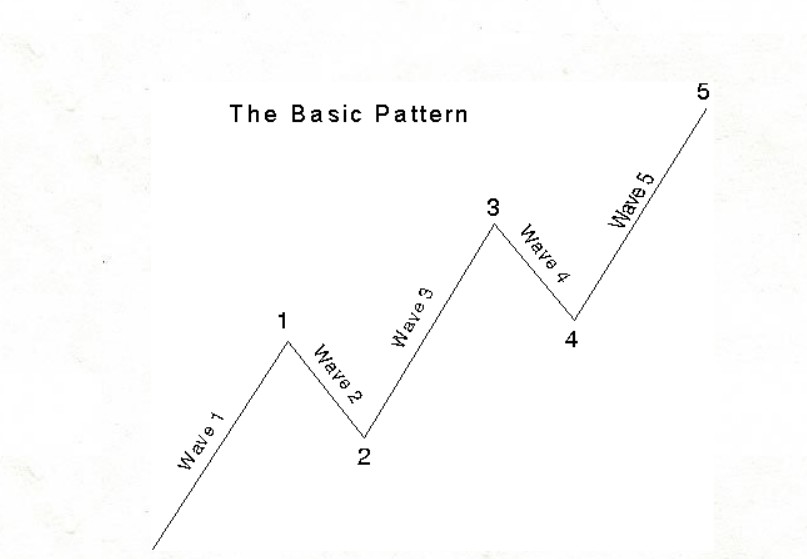

The impulse wave is one of the most fundamental components of Elliott Wave Theory. This wave follows a 5-wave structure that moves in the direction of the overall trend, typically in an upward direction.

Key Rules of the Impulse Wave

- Wave 2 Rule: Wave 2 cannot retrace beyond the starting point of Wave 1.

- Wave 3 Rule: Wave 3 cannot be the shortest of the three upward-moving waves (Waves 1, 3, and 5). Wave 3 is usually the longest and most powerful wave.

- Wave 4 Rule: Wave 4 cannot overlap the peak of Wave 1

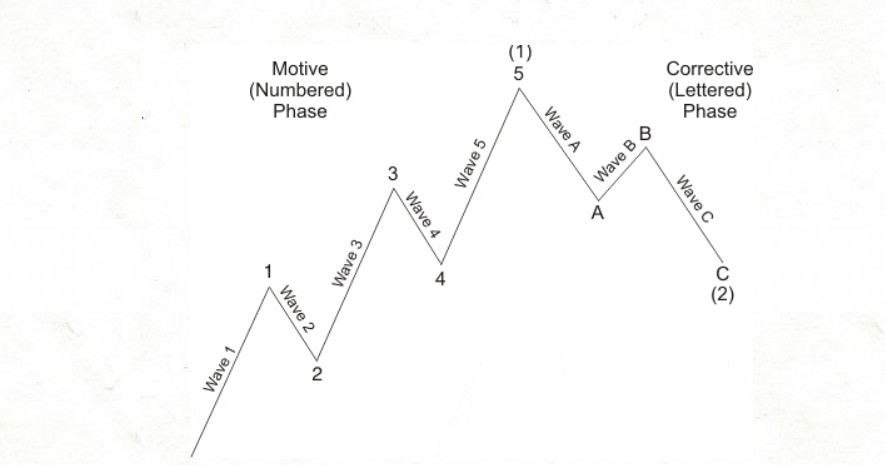

Each impulse wave cycle is made up of five upward-moving waves (1, 3, and 5 are in the main trend, while 2 and 4 are corrective waves) followed by three downward corrective waves labeled A, B, and C.

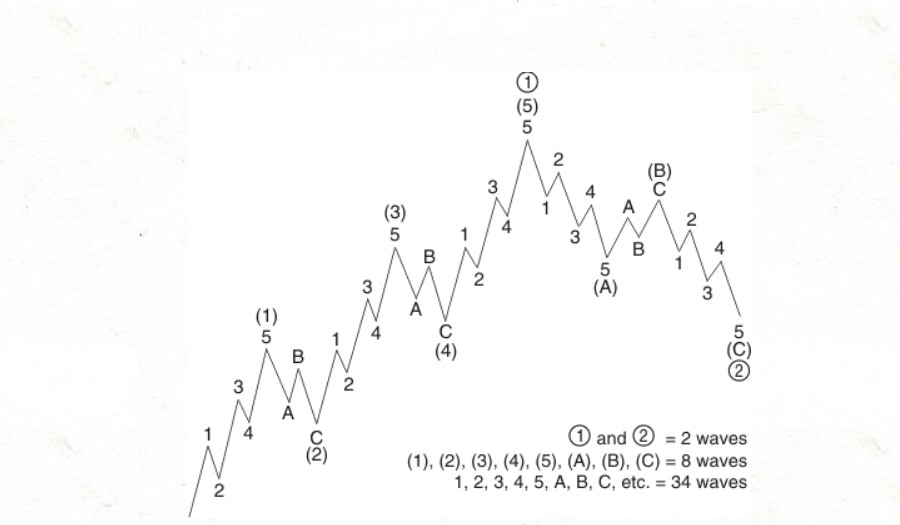

One cycle gathers to create a larger wave, as shown in the figure above.

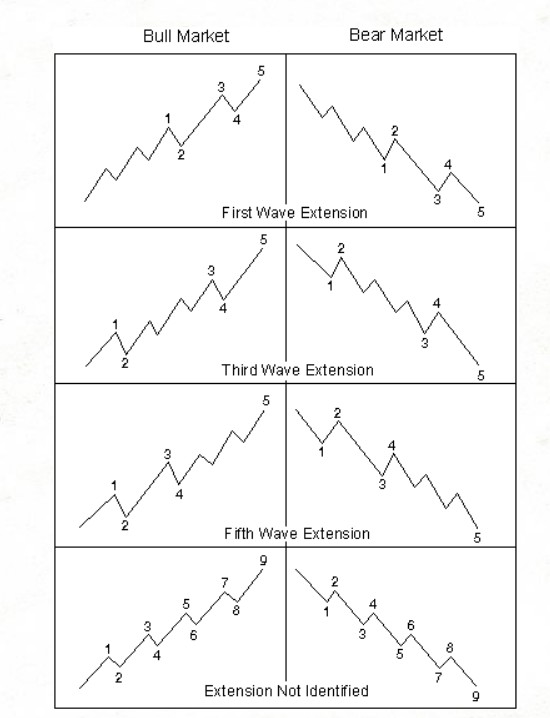

Extensions in Impulse Waves

- In most cases, one of the three upward waves (1, 3, or 5) undergoes an extension, making it longer and more complex.

- If Wave 3 is extended, then Wave 5 is likely to be shorter, and vice versa. When extensions occur, some analysts may count it as a 9-wave movement, but it’s still part of the 5-wave structure of the impulse wave.

- Extensions give an insight into future waves. For example, if Waves 1 and 3 are similar in size, Wave 5 is likely to be larger.

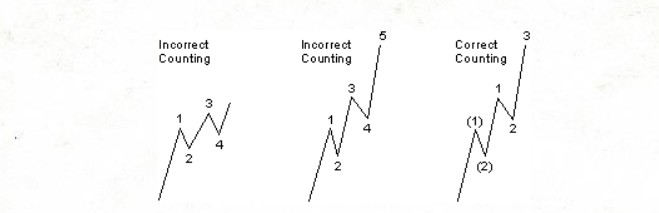

Wave Count Example

An example of common errors in wave counting includes:

- Wave 4 entering Wave 1 territory (invalidates the count),

- Wave 3 being the shortest among Waves 1, 3, and 5, which is incorrect.

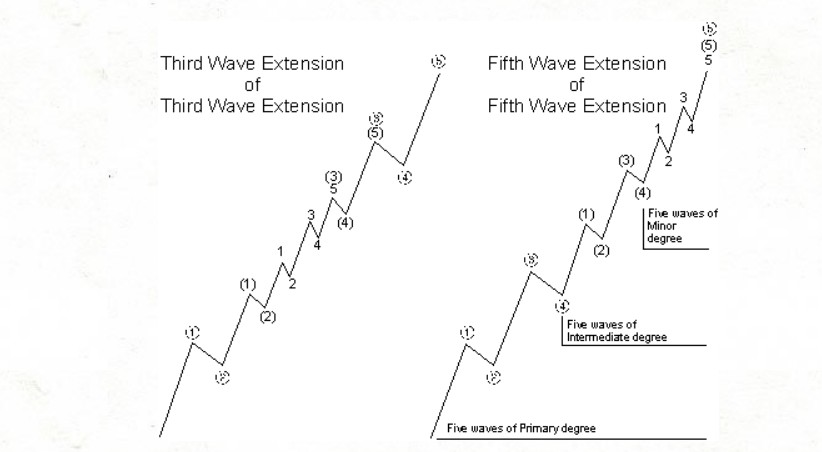

Wave-within-Wave Expansions

Sometimes, an extended wave will contain smaller impulse waves within it. For instance, in a five-wave expansion, small Wave 5 can further break down into a smaller five-wave structure.

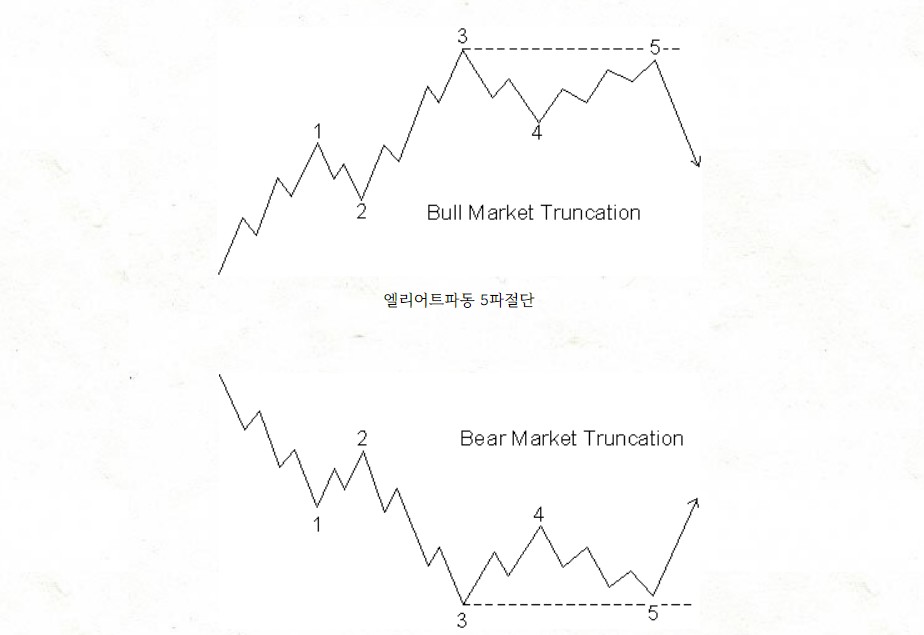

cutting of Elliot Waves

The above figure is about the cutting of Elliott waves.

Although all five waves appeared as small waves, it can be confirmed that they do not exceed the high point of Wave 3.

This pattern usually appears frequently after a strong Wave 3.

Elliott Wave Theory, while complex, offers a structured approach to understanding market cycles and predicting potential market behavior by recognizing the repeating patterns of human psychology in financial markets.

Chart Technical Analysis/Technical AnalysisElliot Wave Theory] Ending Diagonal, Reading Diagonal, Extended Diagonal

In Elliott Wave Theory, diagonal patterns are specialized wave structures that often form in the impulse or correction phase. They come in a few varieties, each with distinct rules and characteristics. Here's a breakdown:1. Leading Diagonal (Reading Diagon

luckyday4u.tistory.com

Elliott Wave Theory ] Complex Corrections [Double Combo,Triple Combo Pattern, WXY -3wave, WXYXZ-5wave]

Double Combo PatternStructure: W-X-Y (3 waves)Appearance Locations:In an impulse wave, during the 2nd or 4th waveIn a zigzag correction, as the B waveAs the A wave in a flat correctionWave Composition:W Wave: Zigzag, double zigzag, triple zigzag, or flatX

luckyday4u.tistory.com

댓글